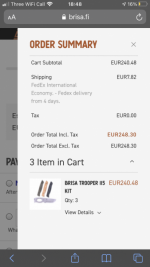

They dont charge VAT, if its going outside the EU, so surely anyone in the UK would be getting it VAT free, and I dont think HMRC would like that.

I think you will find that if it is less than £135 then it is the buyers responsibility to pay the VAT if its above £135 then the buyer must charge VAT and forward it on to HMRC.

But at the moment we have been granted a 3 month extension for parcels.

so how does that work in practise?

Say i order a knife kit from Brisa, it turns up at my house and i havent paid EU VAT, am i supposed to ring the tax man and pay or something?? How would they know? is it like a 'tax honesty box'??

this is ridiculous!